Application of Grounded Theory for Developing an Investment Strategy in the Upstream Oil Industry under Sanctions

Keywords:

Investment, Upstream Oil Industry, Sustainable Production, Sanction Conditions, Grounded TheoryAbstract

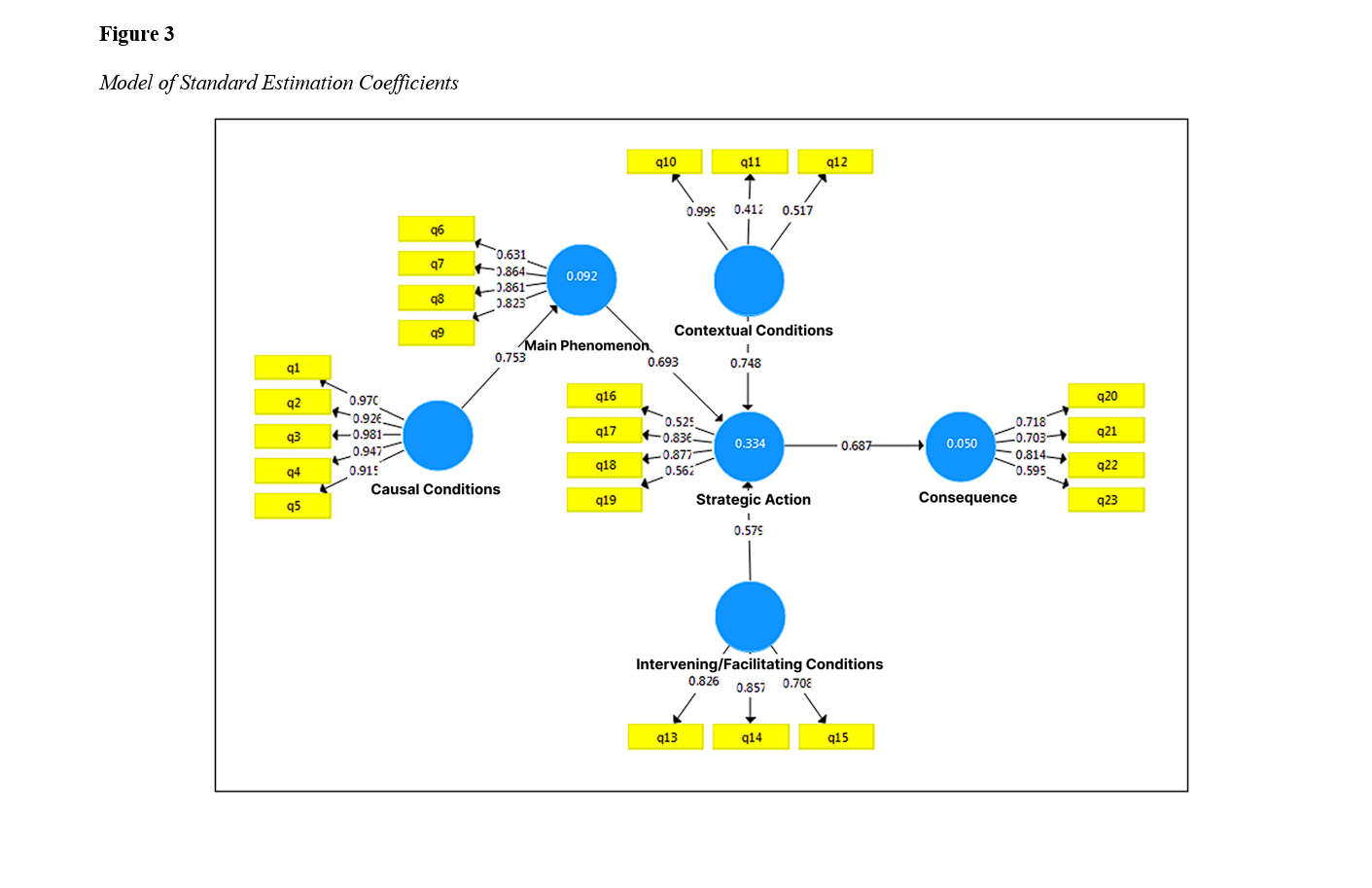

Part of the development of the oil industry requires technology, while another part depends on financing. The intensification of sanctions and international restrictions has had a significant impact on the process of selecting and proposing financing mechanisms. The purpose of this study is to develop an investment strategy in the upstream oil industry aligned with the approach of sustainable (conservation-oriented) production under sanction conditions. The research method is qualitative–quantitative. For data collection in the qualitative section, semi-structured interviews were used. The interviewees were experts employed in one of the active companies in the national oil industry, selected through purposive sampling. Among 14 interviewees, theoretical saturation was achieved with the tenth participant. Data analysis was conducted using grounded theory and, based on Strauss and Corbin’s approach, the final model was developed. In this process, 26 concepts were identified from verbal statements, categorized into 5 themes. For the quantitative validation of the model, structural equation modeling (SEM) was employed. First, questionnaires were designed, and their validity and reliability were examined. Construct, content, convergent, and discriminant validity were confirmed, while reliability was assessed using Cronbach’s alpha and composite reliability, all of which were verified. The questionnaires were then distributed among the statistical sample. The sample consisted of 135 managers and experts from the studied company. Based on the questionnaire data analysis, and given the non-normal distribution of data, the Partial Least Squares (PLS) method was applied using Smart PLS version 2 software. The research model was tested and confirmed. According to these analyses, the impact of causal conditions on the main phenomenon was 0.904, the impact of the main phenomenon on strategy was 0.579, the impact of contextual conditions on strategy was 0.756, the impact of intervening conditions on strategy was 0.628, and the impact of strategy on outcomes was 0.913.

References

Alavi, S. F., Taqizadeh, A., & Ghasabifard, M. J. (2025). Comparing unilateral sanctions and Security Council sanctions: Legal analysis and transnational implications. Legal Civilization, 23(8), 347-370. https://www.pzhfars.ir/article_217902.html?lang=en

Artemkina, L. R., Sopilko, N. Y., Myasnikova, O. Y., Eremina, I. U., Bondarchuk, N. V., & Shamsheev, S. V. (2019). The model of upstream investment portfolio in the mature regions. International Journal of Energy Economics and Policy, 9(4), 173-180. https://doi.org/10.32479/ijeep.7695

Bandarian, R. (2022). Historical analysis of the evolution of global business in the oil industry based on the role of key players and their access to business pillars. Improvement Management, 16(1), 54-92. https://www.behboodmodiriat.ir/article_144001_en.html

Bandarian, R., Bonyadi Naeini, A., & Amirghodsi, S. (2020). A comparative study of the business environment of international and national oil companies and policy recommendations to enhance the competitive advantages of these companies. Energy Law Studies, 6(1), 39-58. https://jrels.ut.ac.ir/article_78052.html

Clews, R. J. (2016). Project finance for the international petroleum industry. Elsevier. https://doi.org/10.1016/B978-0-12-800158-5.00020-7

Dehghani, T. (2019). Investment and financing of oil and gas projects. Institute for International Energy Studies.

Ebneyamini, S., & Bandarian, R. (2019). Explaining the role of technology in the dynamics of the players' business models in the global oil playground. International Journal of Energy Sector Management, 13(3), 556-572. https://doi.org/10.1108/IJESM-09-2018-0004

Fazel, M., Farimani, A., Mu, X., Sahebhonar, H., & Taherifard, A. (2020). An economic analysis of Iranian petroleum contract. Petroleum Science, 17(6), 1451-1461. https://doi.org/10.1007/s12182-020-00486-2

Ghandi, A., & Lin Lawell, C. Y. C. (2017). On the rate of return and risk factors to international oil companies in Iran's buy-back service contracts. Energy Policy, 103, 16-29. https://doi.org/10.1016/j.enpol.2017.01.003

Ghasemi, B., & ValMohammadi, C. (2018). Designing a knowledge management maturity model at a world-class level based on the excellence model: A mixed-method approach. Public Management Research, 11(40), 1. https://www.sid.ir/paper/222091/en

Gholipour, A., & Eftekhari, N. (2016). Proposing a talent management model using grounded theory (case study: mobile operator). Public Management Research, 9(34), 59-90. https://www.sid.ir/paper/364720/en

Haghighi Kafash, M., Esmaeili, M. R., Mohammadian, M., & Taqva, M. R. (2016). Categorization of factors affecting the demand for cultural products in the domestic market. Management Research in Iran, 21(2), 27-46. https://mri.modares.ac.ir/article_436_en.html

Hamilton, M., Cutright, A., Diwan, R., & Fawaz, K. (2021). Oil and gas investment outlook. https://www.ief.org/_resources/files/pages/investment-report-2021/ief_ihs_markit_investment_report.pdf

Hosseini, S. H., Eshagpour, S., & Aghai, S. A. (2016). Evaluating the causes of failures regarding the formulation of comprehensive energy policies in the country. https://rc.majlis.ir/fa/report/show/1008153

Ilinova, A. A., & Solovyova, V. M. (2021). Strategic planning and forecasting: Changing the essence and role in the conditions of energy instability. North Market Formation of Economic Order, 2, 56-68. https://doi.org/10.37614/2220-802X.2.2021.72.005

Jalalifar, B., & Babaei, N. (2016). Examining the effect of fluctuations in crude oil prices on the investment of OPEC member countries in the upstream oil industry. Quarterly Journal of Energy Economics Studies, 12(50), 195-227. https://iiesj.ir/article-1-578-en.html

Jalili, I., Mashbaki, A., Khodadadi Hosseini, S. H., & Azar, A. (2019). Designing a model for implementing the strategy of merging government organizations in Iran. Management Research in Iran, 23(2), 151-181. https://mri.modares.ac.ir/article_498.html

Jamil, F. (2024). Empirical analysis of investment in Pakistan's upstream sector. Resources Policy, 88, 104490. https://doi.org/10.1016/j.resourpol.2023.104490

Kazemi Najaf Abadi, A., & Ghafari, A. (2017). Analyzing the efficiency of different upstream contracts in producing condensate gas reservoirs. Energy Law Studies, 3, 94-95. https://jrels.ut.ac.ir/article_64274.html

Kazemi Nejad, S., Alavani, S. M., & Jamshidi Evanki, M. (2019). Designing a model for implementing energy policies in the oil and gas sector. Quarterly Journal of Energy Economics Studies, 15(62), 37-68. https://iiesj.ir/article-1-1093-en.html

Li, C., Jiang, M., Ge, H., Li, Z., & Luo, D. (2017). An operational risk analysis of Iran buyback contract and its policy implication. Energy Strategy Reviews, 17, 43-53. https://doi.org/10.1016/j.esr.2017.02.003

Mohammadi, R. (2023). A legal examination of smart contracts in the oil, gas, and petrochemical sectors. Research of Nations, 87(8), 71-95. https://ensani.ir/fa/article/534205/

Pierru, A., Almutairi, H., & Smith, J. L. (2021). The value of OPEC's spare capacity to the oil market and global economy. Opec Energy Review, 45(1), 13-36. https://doi.org/10.1111/opec.12199

Razavi, S. M. H., & Salari, M. R. (2020). Reducing the risk of sanctions on subsidiaries of the National Iranian Oil Company: Analyzing solutions with a focus on European Union laws. Legal Studies, 1(12), 75-110. https://jls.shirazu.ac.ir/article_5693.html?lang=en

Razavi, S. M. H., & Zein Al-Dini, F. (2018). The impact of the return of U.S. secondary sanctions on Iran's oil and gas industry: Opportunities and threats. Energy Law Studies, 1(4), 37-60. https://jrels.ut.ac.ir/article_68052.html

Torabzadeh Jahrami, M. S., Hosseini, S. K., & Norouzi, M. (2017). Explanation of policy change using the coalition framework model (case study: Iran's IPC oil contracts). Improvement Management, 11(35), 1-34. https://www.behboodmodiriat.ir/article_49057.html

Vidgen, R., Shaw, S., & Grant, D. B. (2017). Management challenges in creating value from business analytics. European Journal of Operational Research, 261(2), 626-639. https://doi.org/10.1016/j.ejor.2017.02.023

Xu, Z., Frankwick, G. L., & Ramirez, E. (2021). Effects of big data analytics and traditional marketing analytics on new product development. Journal of Business Research, 129, 327-338.

Yates, L. (2021). The role of NOCs on the road to net zero. Wood Mackenzie.

Younesi, K. (2025). A review of the obligation to produce safely within the framework of Iran's oil contracts 10th International Conference of Humanities, Law, Social Studies, and Psychology, Petersburg, Russia. https://en.civilica.com/doc/2294864/

Downloads

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2025 Iman Mohammadi (Author); Hossein Adab; Jalal Haghighat Monfared (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.