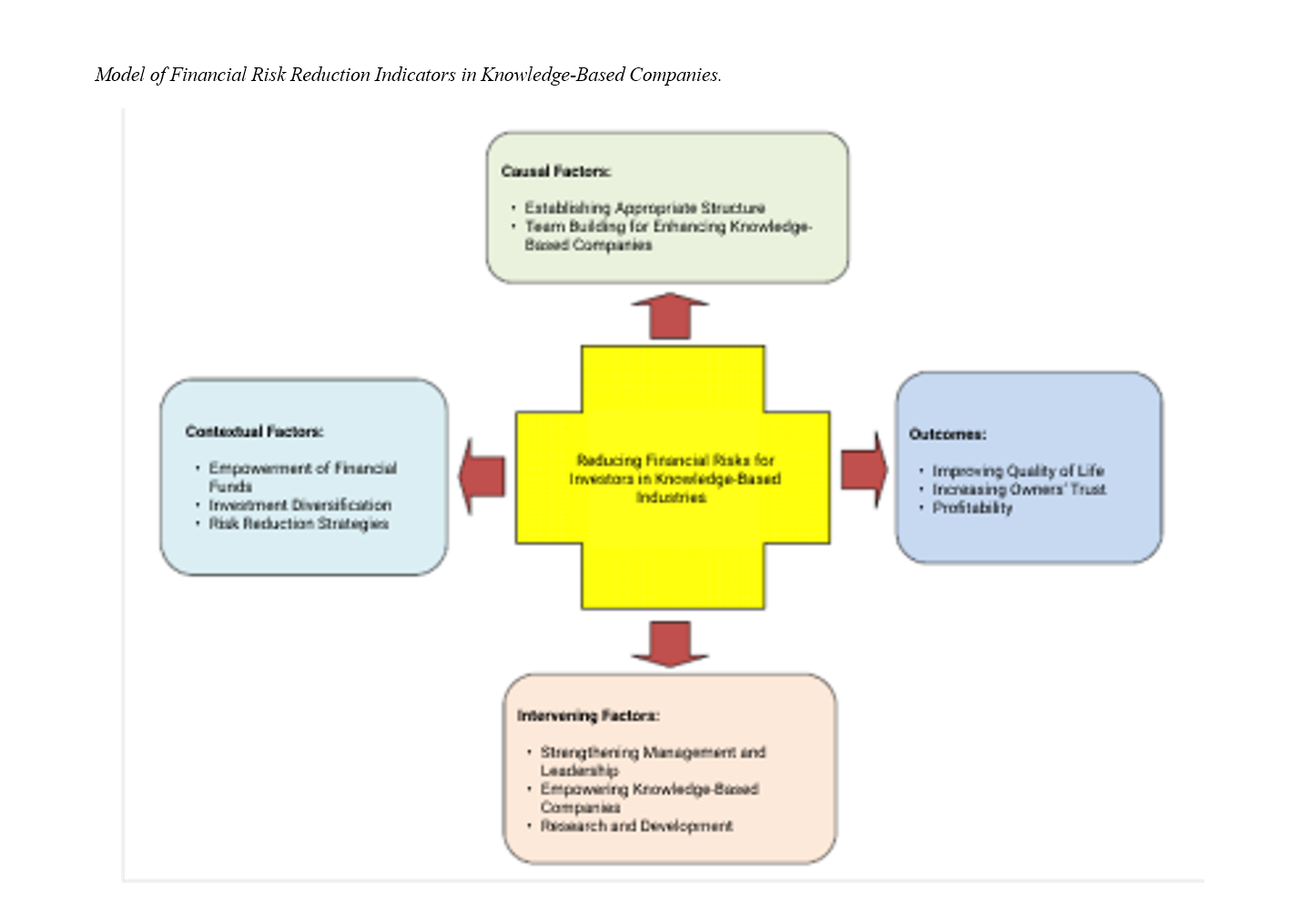

Designing and Explaining a Model for Reducing Financial Risks for Investors in Knowledge-Based Industries in Iran

Keywords:

Financial Risk Reduction, Knowledge-Based Companies, Profitability, Investment DiversificationAbstract

The management of industries often seeks to reduce risk by providing information through various channels such as regulatory institutions and voluntary disclosures. Risk-taking plays a significant role in maintaining the competitive advantage of companies and guides them toward greater economic growth. In competitive environments, companies pursue different strategies to increase their market share and create barriers to entry for others. The selection of each strategy entails acceptance of varying levels of risk and has different impacts on firm-specific risk. The study sample consists of 18 experts, including specialists, managers, and knowledgeable stakeholders, who are considered the statistical population. The criteria for expert selection include comprehensive knowledge of processes within knowledge-based industries in the country and familiarity with financial risk reduction concepts. Participants were selected through purposive sampling and in accordance with the saturation principle. Using grounded theory methodology, the study identified indicators related to financial risk reduction and proposed a conceptual model. The necessity of each extracted component for reducing financial risk in knowledge-based industries and the presentation of a proposed model were examined. The research was analyzed using three stages of coding: open, axial, and selective. The results show that, based on conceptual and secondary codes, the following components were extracted: Causal Factors (e.g., establishing appropriate structures, team-building to promote knowledge-based companies); Contextual Factors (e.g., empowering financial funds, investment diversification, risk reduction strategies); Intervening Factors (e.g., enhancing management and leadership, empowering knowledge-based companies, research and development); Outcomes (e.g., improving quality of life, increasing owners’ trust, profitability). The identified components enable the creation of a real-time, risk-reducing work environment.

References

Abduljabbar, N., & Breesam, H. (2022). Risk assessment process for the Iraqi petroleum sector. Journal of the Mechanical Behavior of Materials, 31, 748-754. https://doi.org/10.1515/jmbm-2022-0018

Adil, M., Singh, Y., & Ansari, M. S. (2022). How financial literacy moderate the association between behaviour biases and investment decision? Asian Journal of Accounting Research, 7(1), 17-30. https://doi.org/10.1108/AJAR-09-2020-0086

Asgarnejad Noori, B., & Emkani, P. (2017). The Impact of Effective Risk Management on the Financial Performance of Companies Listed on the Tehran Stock Exchange: The Mediating Role of Intellectual Capital and Financial Leverage. Asset Management and Financing, 5(2), 112-193. https://ensani.ir/fa/article/377467/

Bagheri, M., & Lotfallian, M. (2024). Examining the Impact of Financial and Operational Risks on Audit Quality in Companies Listed on the Tehran Stock Exchange. 7th International Conference on Innovative Ideas in Management, Economics, Accounting, and Banking,

Bartolacci, F., Caputo, A., & Soverchia, M. (2020). Sustainability and Financial Performance of Small and Medium Sized Enterprises: A Bibliometric and Systematic Literature Review. Business Strategy and the Environment, 29(3), 1297-1309. https://doi.org/10.1002/bse.2434

Bozkaya, A., & Van Pottelsberghe De La Potterie, B. (2008). Who Funds Technology-Based Small Firms? Evidence from Belgium. Economics of Innovation and New Technology, 17(1-2), 97-122. https://doi.org/10.1080/10438590701279466

Bronzini, R., Caramellino, G., & Magri, S. (2017). Venture capitalists at work: What are the effects on the firms they finance? https://doi.org/10.2139/ssrn.3048277

Darban Fooladi, J., & Tabasi Lotf Abadi, V. (2024). Evaluating Investors' Financial Risk Tolerance in the Capital Market. New Explorations in Computational Sciences and Behavioral Management. https://doi.org/10.22034/necsbm.2024.462684.1060

Eskandari, R., & Kordestani, G. (2024). Agency Costs and the Relationship of Financial Distress Risk with Stock Price Decline Risk. Financial Management Strategy, 12(2). https://jfm.alzahra.ac.ir/article_7751.html

Knudsen, E. S., Hage, F. P., & Vethe, M. B. (2023). The more, the merrier: Performance effects of cash over the business cycle. Scandinavian Journal of Management, 39(1). https://doi.org/10.1016/j.scaman.2022.101255

Motaghi, S., Mobaser, A., & Saber, N. (2023). Technical Analysis and Financial Risk Reduction in the Stock Market: A Case Study of Karaj Brokerage Firms. 6th International Conference on New Developments in Management, Economics, and Accounting, Tehran.

Nazemi Manbari, S., & Asgharzadeh, G. (2022). Investigating the effect of past behavior and financial literacy on investors' investment decisions in the framework of the theory of planned behavior in Tehran Stock Exchange. Studies of Economy, Financial Management and Accounting, 1(8), 87-98.

Osouliyan, M., Mohammad Fadaei Nejad, I., & Gheitasi, S. (2022). Managerial Predictions, Company-Specific Risks, and the Informational Environment (Evidence from Companies Listed on the Tehran Stock Exchange). Journal of Asset Management and Financing, 10(1), 25-46. https://amf.ui.ac.ir/article_26649.html

Pan, C., Huang, X., & Sun, W. (2022). Research on Risk Management of Petrochemical Supply Chain Based on Network Dynamic Evolution Model. Proceedings of 2021 Chinese Intelligent Automation Conference. https://doi.org/10.1007/978-981-16-6372-7_26

Rao, P., Kumar, S., Chavand, M., & Weng Marc Lim, W. (2021). A Systematic Literature Review on SME Financing: Trends and Future Directions. Journal of Small Business Management, 1-31. https://doi.org/10.1080/00472778.2021.1955123

Rostami Nourzabad, M., Badami, M. H., & Eshtehri, M. (2022). Dimensions of Risk Management Development in the Business Model and Culture of Financial Industry Organizations in Iran. Journal of Asset Management and Financing. https://www.noormags.ir/view/fa/articlepage/2059473/

Sajoodi, S., Mohammadzadeh, P., & Fateh, A. (2020). Examining the Effect of Financing from Venture Capital Funds on the Profitability of Knowledge-Based Companies. https://jstp.nrisp.ac.ir/article_13804.html

Shahrastani, S., & Boostan Fath Abadi, M. (2024). Examining the Impact of Financial Literacy, Investment Risk, and Willingness to Invest in the Tehran Stock Exchange. 3rd International Conference on Political Science, Management, Economics, and Accounting, Hamadan.

Shakerzavardehi, F., Ebrahimi, S. K., & Jalali, F. (2021). The Effect of External Financing Activities on Earnings Smoothing Considering the Moderating Role of Organizational Risk Management. 2nd International Conference on Challenges and Innovative Solutions in Industrial Engineering, Management, and Accounting,

Wang, X., Cao, Y., Feng, Z., Lu, M., & Shan, Y. (2023). Local FinTech development and stock price crash risk. Finance Research Letters, 53, 103644. https://doi.org/10.1016/j.frl.2023.103644

Downloads

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2025 Mehdi Babadi Shoorab (Author); Zahra Moradi ; Zohreh Hajiha (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.