Presenting a Model for Effective Internal Audit and its Impact on Good Governance in Iran's Public Sector Using Grounded Theory

Keywords:

Internal audit, good governance, public sector, grounded theoryAbstract

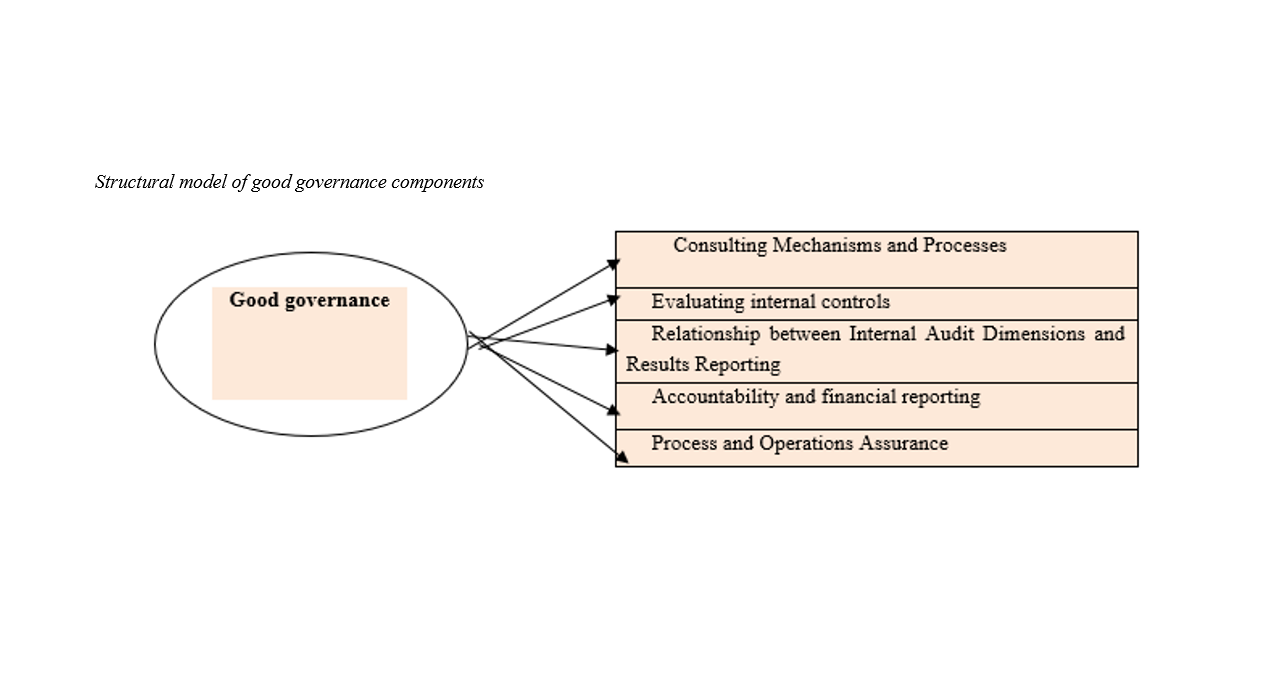

This research aims to present an effective internal audit model and its impact on good governance in Iran's public sector. The present study is an applied research applying mixed (qualitative and quantitative) methods. The statistical population of the qualitative section included all Iranian experts, academic professors, managers, and audit experts. The data were collected through semi-structured interviews and analyzed using the Strauss and Corbin coding method. In the second stage, regarding the assumed standard sample, the research sample was determined by applying the Cochran formula, and 183 experts and connoisseurs were selected through the Convenience judgmental Sampling method. The results revealed that the experts agreed upon key dimensions and components for auditing activity using the data-based method, which included 104 indicators, 14 components, and 5 dimensions. According to the results, internal auditing plays a significant role in increasing the internal control system, improving the risk management process, and the regulatory agencies and people's satisfaction, and promoting the executive managers' and employees' accountability against the public. Internal auditors can play a prominent role in establishing and promoting good governance indicators in the public sector, but implementing this requires reforms in the current internal audit oversight system.

References

Asadzadeh, H., & Nikbakht, M. (2024). A Conceptual Model for Determining the Effective Size of the Internal Audit Unit. Accounting Knowledge and Management Auditing, 13(49). https://www.jmaak.ir/article_18014.html?lang=en

Babajani, J., Azar, A., & Moeiri, M. (2013). Factors and drivers of change in the financial and operational accountability system of the Iranian public sector. Quarterly Journal of Empirical Studies in Financial Accounting, 11(37), 1-36. https://qjma.atu.ac.ir/article_1271.html?lang=en

Bamari, O., Shorvarzi, M. R., & Noori Topkanlou, Z. (2024). Investigating and explaining the relationship between internal auditing and the quality of financial reporting. Accounting and Auditing Management Knowledge, 14(53), 291-304.

Bryson j, M., Barbara, C. C., & Laura, B. (2014). Public Value Governance: Moving beyond Traditional Public Administration and the New Public Management. Public Administration Review, 74(4), 445-456. https://doi.org/10.1111/puar.12238

Cordery, C. J., & Hay, D. (2017). Supreme audit institutions and public value: Demonstrating relevance. Financial Accounting & Management, 99-127. https://doi.org/10.2139/ssrn.2895804

Cordery, C. J., & Hay, D. (2019). Supreme audit institutions and public value: Demonstrating relevance. In Financial Accounting & Management. https://doi.org/10.4324/9780429201639-3

De Jong, J., Douglas, S., Sicilia, M., Radnor, Z., Noordegraaf, M., & Debus, P. (2017). Instruments of value: Using the analytic tools of public value theory in teaching and practice. Public Management Review, 19(5), 605-620. https://doi.org/10.1080/14719037.2016.1192162

Djogo, Y. O. (2023). Internal Auditor Human Resources Development Strategy in the Era of Disruption. Atestasi Jurnal Ilmiah Akuntansi, 6(2), 627-639. https://doi.org/10.57178/atestasi.v6i2.723

Douglas, J., & Raudla, R. (2015). The Impact of Performance Audit on Public Sector Organizations: The Case of Estonia. Public Organization Review, 1-17. https://www.researchgate.net/publication/276698073_The_Impact_of_Performance_Audit_on_Public_Sector_Organizations_The_Case_of_Estonia

En-nejjari, M., El Aissaoui, H., & Lakhouil, A. (2024). Evaluation of the effectiveness of internal audit in local authorities: Case of Moroccan communes. African Scientific Journal, 3(23), 20-37.

Farhadi Touski, O., & Doustian, R. (2025). Developing New Technologies in Internal Auditing with the Help of Artificial Intelligence: Deep Learning Enables Anomaly Detection in Financial Accounting Data. Investment Knowledge, 14(55), 597-612. https://doi.org/10.30495/jik.2025.23638

Gustavson, M. (2014). Auditing Good Government in Africa: Public Sector Reform, Professional Norms and the Development Discourse. UK. https://doi.org/10.1057/9781137282729

Hay, D., Simpkins, K., & Cordery, C. J. (2016). Investigation 1: The value of public audit. https://www.wgtn.ac.nz/cagtr/occasional-papers/documents/introductory-material.pdf

Ismail, S., Abdou, R. M., & Ibrahim, M. S. (2025). Who is Better in Practicing Customer Due Diligence as an Anti-Money Laundering Tool for Financial Institutions: Can Internal Auditors Be Forensic Accountants? Evidence from MENA Region. In Sustainable Data Management: Navigating Big Data, Communication Technology, and Business Digital Leadership. Volume 1 (pp. 11-23). https://doi.org/10.1007/978-3-031-83911-5_2

Khanam, Z. (2024). Effectiveness of internal auditing from the lens of internal audit factors: empirical findings from the banking sector of Bangladesh. Journal of Financial Crime, ahead-of-print, ahead-of-print. https://doi.org/https://doi.org/10.1108/JFC-11-2023-0299

Mashayekhi, B., & Yazdanian, A. (2018). Identifying the key elements of internal audit. Accounting and Auditing Reviews, 25(1), 135-158. https://acctgrev.ut.ac.ir/article_66304.html

Mayuree, Y. (2018). Examining Progress in Research on Public Value. Kasetsart. Journal of Social Sciences, 39, 168-173. https://doi.org/10.1016/j.kjss.2017.12.005

Molaei, A. (2024). Organizational Environment and Whistleblowing Mindset Among Internal Auditors. Quarterly Journal of New Research Approaches in Management and Accounting, 8(92), 1996-2011. https://majournal.ir/index.php/ma/article/view/2630

Msindwana, M. C., & Ngwakwe, C. C. (2022). Internal audit effectiveness and financial accountability in the provincial treasuries of South Africa. International Journal of Economics and Financial Issues, 12(3), 86-96. https://doi.org/10.32479/ijefi.13017

Nurmawanti, S., Lenggogeni, L., & Yanti, H. B. (2024). The Effect of Competence, Time Budget Pressure and Professional Attitudes of Auditors on Internal Audit Quality With Role Conflict As a Moderating Variable. Dinasti International Journal of Economics, Finance & Accounting (DIJEFA), 4(6).

Pollitt, C., & Bouckaert, G. (2011). Public Management Reform: A Comparative Analysis. Oxford University Press. http://ndl.ethernet.edu.et/bitstream/123456789/40090/1/102.Christopher%20Pollitt.pdf

Rialdy, N., Sari, M., Hani, S., Jufrizen, J., & Irfan, I. (2023). Internal Auditor Professionalism: Determinants and Its Effect on Behavior Auditor Ethics. Integrated Journal of Business and Economics, 7(3), 518-532. https://doi.org/10.33019/ijbe.v7i3.651

Salarzehi, H. O., & Ebrahimpour, H. (2012). Paradigms of Public Administration: From Traditional Public Administration to Good Governance. Journal of Public Administration, 43-62. https://jipa.ut.ac.ir/article_28723.html

Van der Wal, Z., Nabatchi, T., & de Graaf, G. (2013). From Galaxies to Universe: A Cross-Disciplinary Review and Analysis of Public Values Publications from 1969 to 2012. American Review of Public Administration. https://doi.org/10.1177/0275074013488822

Volodina, T., Grossi, G., & Vakulenko, V. (2023). The changing roles of internal auditors in the Ukrainian central government. Journal of Accounting & Organizational Change, 19(6), 1-23. https://doi.org/10.1108/JAOC-04-2021-0057

Xanthopoulou, A. (2024). The Effect of Internal Audit on Universities’ Reliability and Performance. 987-994. https://doi.org/10.1007/978-3-031-51038-0_106

Zhang, C., & Sabarina, M. S. (2022). The Impact of Blockchain Technology on Internal Auditing in the Financial Sector. https://www.researchgate.net/publication/367584504_The_Impact_of_Blockchain_Technology_on_Internal_Auditing_in_the_Financial_Sector

Downloads

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2025 Ali Nikpour, Mahmoud Lari Dasht Biyaz, Habibollah Nakhaei (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.