Identification and Prioritization of Factors Affecting Digital Financial Innovation Using the Structural Equation Modeling Approach

Keywords:

Model design, digital financial innovation, grounded theoryAbstract

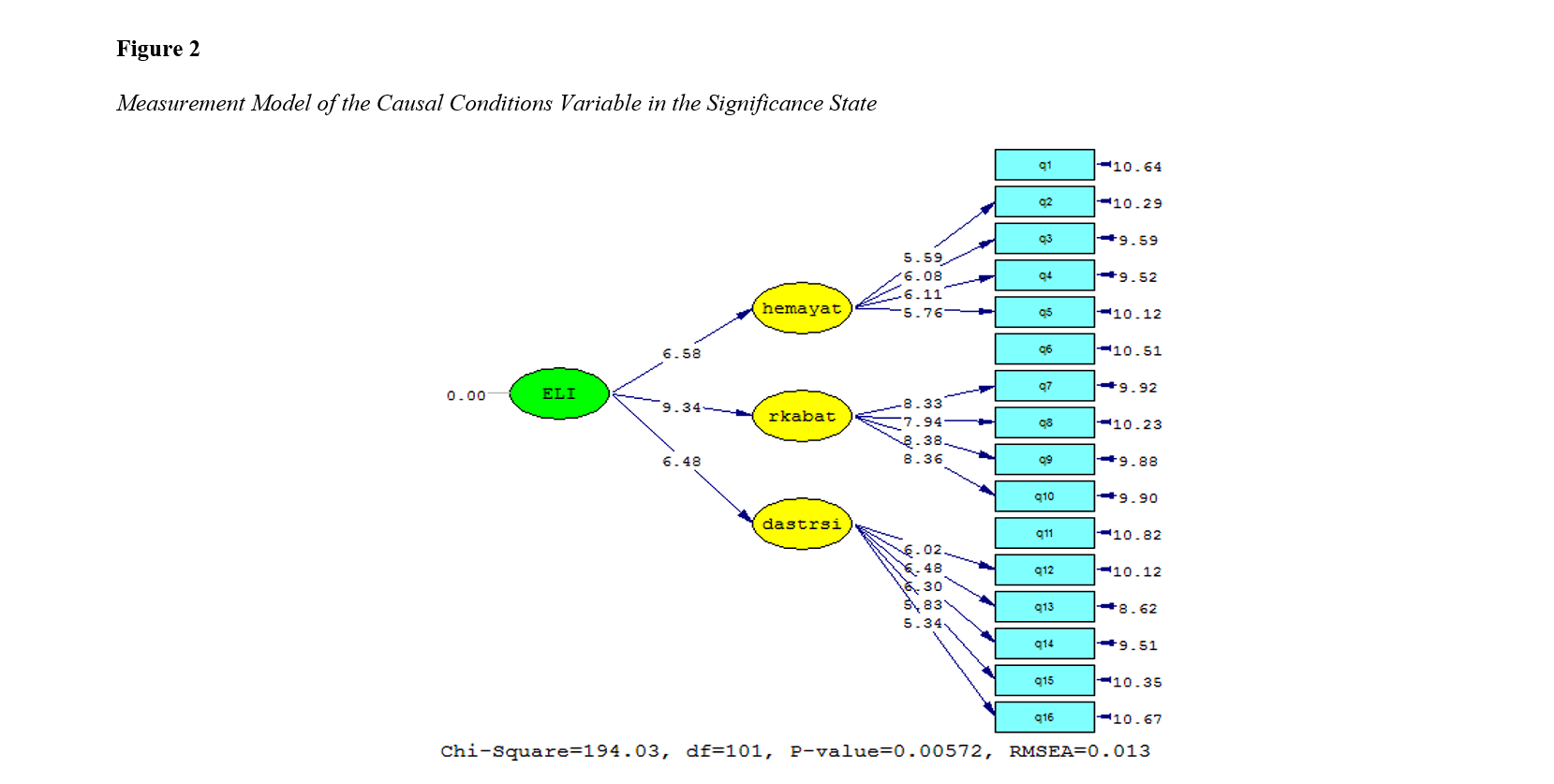

The purpose of this study was to identify and prioritize the factors influencing digital financial innovation using the structural equation modeling approach. The research employed both qualitative and quantitative methods. Data were collected through interviews. The statistical population consisted of professors and experts in the field of accounting, with no defined limit; however, 18 participants were selected until theoretical saturation was achieved. The sampling method was snowball sampling, whereby interviewees were asked to introduce knowledgeable individuals relevant to the research topic for subsequent interviews. The primary data were collected through interviews. In accordance with the methodological process, data analysis was carried out in three stages: open coding, axial coding, and selective coding. Initially, from the large volume of primary data, codes related to the research topic were identified. Subsequently, using the method of constant comparison, concepts were extracted from several codes, and in the same manner, other codes were transformed into concepts. Ultimately, 93 concepts were derived. In the next stage, several concepts were grouped into categories, resulting in 18 categories for this study.The findings revealed that three categories emerged as the core categories: acceptance capability, information and communication technology (ICT) infrastructure, and the level of digital literacy and awareness. The remaining categories were presented in the proposed model across five groups: causal conditions (3 categories), context or background (3 categories), intervening conditions (3 categories), strategies (3 categories), and consequences (3 categories). Subsequently, based on the indicators, components, concepts, and categories of the proposed model, a 93-item questionnaire was developed. Using the data collected, the relationships of the proposed model were examined, and the results ultimately indicated the significance of the relationships and components of the presented model.

References

Abbas, J., Balsalobre-Lorente, D., Amjid, M. A., Al-Sulaiti, K., Al-Sulaiti, I., & Aldereai, O. (2024). Financial innovation and digitalization promote business growth: The interplay of green technology innovation, product market competition and firm performance. Innovation and Green Development, 3(1), 100111. https://doi.org/10.1016/j.igd.2023.100111

Alizadeh, H., Khorramabadi, M., Saberian, H., & Keramati, M. (2024). Qualitative Study to Propose Digital Marketing based on Customer experience: Considering Grounded theory (GT). Business, Marketing, and Finance Open, 1(6), 86-98. https://doi.org/10.61838/bmfopen.1.6.8

Bahmani, S. (2020). Identifying and Ranking Factors Affecting the Selection of FinTechs and Digital Innovations in Sepah Bank of Qom. In. Qom: Tolu'e Mehr Higher Education Institute - Qom, Management Department.

Barati, F., & Safari, K. (2021). The Impact of Knowledge Management Practices on Digital Financial Innovation Considering the Moderating Role of Managers' Characteristics in Banks Located in Shiraz. The 7th National Conference on Modern Research in Management, Economics, and Accounting of Iran, Tehran.

Barnes, S. J. (2020). Information management research and practice in the post-COVID-19 world. Int. J. Inf. Manag., 55, 102175. https://doi.org/10.1016/j.ijinfomgt.2020.102175

Chang, L., Zhang, Q., & Liu, H. (2022). Digital finance innovation in green manufacturing: a bibliometric approach. Environmental Science and Pollution Research. https://doi.org/10.1007/s11356-021-18016-x

Darikandeh, M. M., & Kheiri, M. (2023). Investigating the Moderating Role of Digital Business Strategy Alignment on the Impact of Organizational Readiness and Digital Financial Innovation. In. Qeshm: Qeshm Institute of Higher Education, Accounting and Finance Department.

Di Vaio, A., Palladino, R., Pezzi, A., & Kalisz, D. E. (2021). The role of digital innovation in knowledge management systems: A systematic literature review. Journal of Business Research, 123, 220-231. https://doi.org/10.1016/j.jbusres.2020.09.042

Du, M., Chen, Q., Xiao, J., Yang, H., & Ma, X. (2020). Supply chain finance innovation using blockchain. IEEE Trans. Eng. Manag., 67, 1045-1058. https://doi.org/10.1109/TEM.2020.2971858

Duygan, M., Fischer, M., & Ingold, K. (2023). Assessing the readiness of municipalities for digital process innovation. Technology in Society, 72, 102179. https://doi.org/10.1016/j.techsoc.2022.102179

Effiom, L., & Edet, S. E. (2020). Financial innovation and the performance of small and medium scale enterprises in Nigeria. Journal of Small Business & Entrepreneurship, 1-34. https://doi.org/10.1080/08276331.2020.1779559

Fazeli Kabria, H., Chakin, M., Babaei Samiromi, M. R., & Azizabadi Farahani, P. (2021). Investigating the Impact of Intellectual Capital and Innovation on Financial Performance (A Study of the Mapna Industrial Group). Innovation and Creativity in Humanities, 11(1), 23-43. https://sid.ir/paper/1032539/fa

Frangos, P. (2022). An Integrative Literature Review on Leadership and Organizational Readiness for AI. European Conference on the Impact of Artificial Intelligence and Robotics,

Gao, F., Lin, C., & Zhai, H. (2022). Digital transformation, corporate innovation, and international strategy: Empirical evidence from listed companies in China. Sustainability, 14(13), 8137. https://doi.org/10.3390/su14138137

Khin, S., & Ho, T. C. F. (2019). Digital technology, digital capability and organizational performance. Int. J. Innovat. Sci., 11, 177-195. https://doi.org/10.1108/IJIS-08-2018-0083

Lam, H. K., Zhan, Y., Zhang, M., Wang, Y., & Lyons, A. (2019). The effect of supply chain finance initiatives on the market value of service providers. Int. J. Prod. Econ., 216, 227-238. https://doi.org/10.1016/j.ijpe.2019.04.031

Longworth, D. (2020). The Era of Digital Financial Innovation: Lessons from Economic History on Regulation. 568. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3562560

Mousavi Samanani, S. J., & Taleb Nia, G. (2024). Investigating the Effect of Organizational Readiness on Financial Resilience with the Mediation of Digital Financial Innovation in the Municipality of Semnan City. In. Semnan: Adiban Higher Education Institute, Management Department.

Nasiri, M., Ukko, J., Saunila, M., Rantala, T., & Rantanen, H. (2020). Digital-related capabilities and financial performance: the mediating effect of performance measurement systems. Technol. Anal. Strat. Manag., 32, 1393-1406. https://doi.org/10.1080/09537325.2020.1772966

Nasser, M., & Razavi, S. M. H. (2019). Legal Analysis of the Function of Smart Contracts in Digital Transfers in Financial Markets. Commercial Research Journal, 24(93), 33-70. https://pajooheshnameh.itsr.ir/article_38462.html?lang=en

Nejad, M. G. (2022). Research on financial innovations: An interdisciplinary review. International Journal of Bank Marketing, 40(3), 578-612. https://doi.org/10.1108/IJBM-07-2021-0305

Rajabpour, F., & Alizadeh, H. (2024). Investigating the impact of environmental factors on the adoption of social media among small and medium enterprises during the Covid-19 crisis. The 6th National Conference and the 3rd International Conference on New Patterns of Business Management in Unstable Conditions,

Shokri, N., Sahab Khodamoradi, M., & Hajiloo moghadam, A. H. (2021). Investigating the Spillover Effects of Financial Volatility Among Cryptocurrencies (Application of a Multivariate GARCH Approach). Financial Management Perspective, 11(35), 143-172. https://doi.org/10.52547/jfmp.11.35.143

Tavakoli Tor'ei, M. (2020). Investigating the Role of Digital Innovations in Knowledge Management Systems: A Review of Research from the Last Decade. National Conference on Management, Accounting, and Industrial Engineering,

Wang, Y., Xiuping, S., & Zhang, Q. (2021). Can fintech improve the efficiency of commercial banks?-an analysis based on big data. Res. Int. Bus. Finance, 55, 101338. https://doi.org/10.1016/j.ribaf.2020.101338

Zhou, G., Zhu, J., & Luo, S. (2022). The impact of fintech innovation on green growth in China: Mediating effect of green finance. Ecological Economics, 193, 107308. https://doi.org/10.1016/j.ecolecon.2021.107308

Downloads

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2025 Akbar Abedi (Author); Farhad Hanifi; Mirfeiz Fallah Shams (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.