Modeling the Probability of Bankruptcy of Listed Companies Using Classification Algorithms (Random Forest, XGBoost, SVM)

Keywords:

Bankruptcy Prediction, Machine Learning, XGBoost, Random Forest, Support Vector Machine, Financial Distress, Tehran Stock ExchangeAbstract

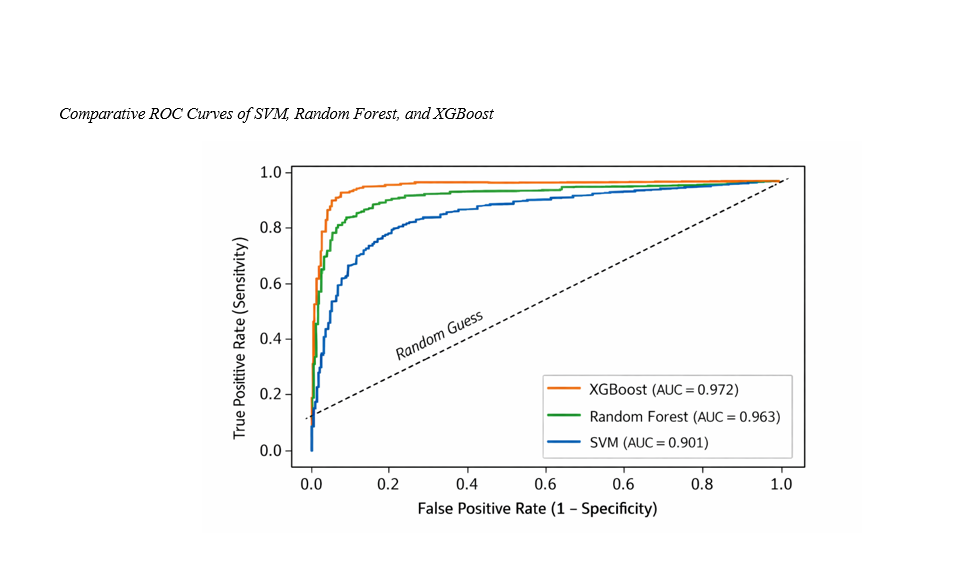

The objective of this study is to develop and compare advanced machine learning models for predicting corporate bankruptcy among firms listed on the Tehran Stock Exchange in order to identify the most effective classification framework for early financial distress detection. This research employed a quantitative predictive design using financial data from 185 non-financial firms listed on the Tehran Stock Exchange over the period 2013–2023. A total of 1,850 firm-year observations were extracted from audited financial statements and official market databases. Key financial indicators covering liquidity, leverage, profitability, efficiency, growth, cash flow, and firm size were constructed and standardized. The dataset was divided into training and testing subsets, and three classification algorithms—Random Forest, XGBoost, and Support Vector Machine—were implemented. Hyperparameters were optimized using grid search with cross-validation, and model performance was evaluated using accuracy, precision, recall, F1-score, and area under the ROC curve. The XGBoost model achieved the highest predictive accuracy (93.1%) and the largest area under the ROC curve (0.972), followed by Random Forest (accuracy = 91.7%, AUC = 0.963) and Support Vector Machine (accuracy = 86.1%, AUC = 0.901). Feature importance analysis revealed that return on assets, operating cash flow to total debt, leverage ratios, and profitability indicators were the most influential predictors of bankruptcy risk. The results demonstrate that ensemble learning algorithms, particularly XGBoost, provide superior performance in bankruptcy prediction within the Tehran Stock Exchange, offering a reliable framework for early financial distress detection and enhanced financial risk management.

References

Agustia, D., Muhammad, N. P. A., & Permatasari, Y. (2020). Earnings Management, Business Strategy, and Bankruptcy Risk: Evidence From Indonesia. Heliyon, 6(2), e03317. https://doi.org/10.1016/j.heliyon.2020.e03317

Andiranto, W. (2023). Prediction of Potential Bankruptcy of Mining and Petroleum Companies in Indonesia. Journal of Economics Finance and Management Studies, 06(07). https://doi.org/10.47191/jefms/v6-i7-27

Antwi, J. S., Salifu, I., & Sarkodie, E. E. (2022). Predicting Bankruptcy of Companies: Evidence From Ghanaian Listed Banks. International Journal of Finance, 7(2), 56-82. https://doi.org/10.47941/ijf.920

Cathcart, L., Dufour, A., Rossi, L., & Varotto, S. (2024). Corporate Bankruptcy and Banking Deregulation: The Effect of Financial Leverage. Journal of Banking and Finance. https://doi.org/10.1016/j.jbankfin.2024.107219

Georgios, D. K., & Georgios, M. (2023). Predicting Bankruptcy on Oil Companies Before and After the Pandemic Using Two Altman's Z-Score Models. Industrial and Emerging Markets. Evidence From Greece. Journal of Economics Finance and Management Studies, 06(11). https://doi.org/10.47191/jefms/v6-i11-54

Ghasemi, M., Sarraf, F., Ahadi, Y., & Jafari, S. M. (2024). Presenting a financial resilience model in Tehran Stock Exchange companies to prevent bankruptcy. Investment Knowledge, 13(51), 623-643.

Ghatabi, M., Khodadadi, V., Jerjerzadeh, A., & Kaab Amir, A. (2024). Examining the Impact of Accrual Earnings Management Mechanisms on the Predictive Power of Bankruptcy Models. Journal of Accounting and Management Auditing, 13(50), 45-60.

Hoque, E., Hossain, T., & Saha, T. (2022). Predicting the Bankruptcy of Cement Companies in Bangladesh: A Study on Dhaka Stock Exchange. International Journal of Business Economics and Management, 9(5), 162-174. https://doi.org/10.18488/62.v9i5.3207

Jannati Asl, S. S. F. (2024). Examining the Moderating Role of Trade Credit on the Relationship Between Financial Flexibility and Bankruptcy of Companies Listed on the Tehran Stock Exchange. New Research Approaches in Management and Accounting, 8(28), 1571-1585. https://majournal.ir/index.php/ma/article/view/2450

Jones, H. (2024). Recognition of Foreign Insolvency and Bankruptcy Proceedings in England & Wales. Rosenblatt.

Mattos, E. D. S., & Shasha, D. (2024). Bankruptcy prediction with low-quality financial information. Expert Systems with Applications, 237. https://doi.org/10.1016/j.eswa.2023.121418

Nafisa, A., Muhammad, H., & Sari, N. P. (2022). Corporate Bankruptcy: Evidence From the Plastics and Packaging Industry in Indonesia. International Journal of Research in Business and Social Science (2147-4478), 11(6), 165-174. https://doi.org/10.20525/ijrbs.v11i6.1942

Nezami, M. N., Nodeh, F. M., & Khordyar, S. (2025). Modeling Bankruptcy Prediction with Emphasis on Modern Measurement Methods Using Neural Networks and Support Vector Machines. Journal of Accounting and Management Auditing, 55, 265-278.

Ogachi, D., Ndege, R. M., Gaturu, P., & Zéman, Z. (2020). Corporate Bankruptcy Prediction Model, a Special Focus on Listed Companies in Kenya. Journal of Risk and Financial Management, 13(3), 47. https://doi.org/10.3390/jrfm13030047

Rabiei, K., & Fotouhi Fashtami, H. (2025). Investigating the Nonlinear Impact of Earnings Management and Business Strategy on Corporate Bankruptcy Risk Using the Generalized Method of Moments (GMM). Management Accounting and Auditing Knowledge, 14(56), 183-192. https://www.jmaak.ir/article_23510.html?lang=en

Rouintan, S. A. R., Peykarjou, K., & Khalili Araqi, M. (2024). Testing the Financial Engineering Approach in Measuring Corporate Distress and Bankruptcy. Investment Knowledge, 13(51), 435-460.

Sam Deliri, B., & Ramezani, M. (2024). Investigating the role of distress and financial stress on financial crises: Preventing corporate bankruptcy. Third International Congress on Management, Economics, Humanities, and Business Development,

Sharma, S., & Bhag, S. (2024). A Bibliometric Analysis of Corporate Bankruptcy Prediction Research: Trends and Insights. https://doi.org/10.52783/jier.v4i2.758

Tsabita, N. M., & Gunadi, A. (2025). Corporate governance failures leading to bankruptcy in state-owned enterprises (SOEs). Subsidiari, 10(2). https://acopen.umsida.ac.id/index.php/acopen/article/view/12991

Wicaksono, A. (2023). Legal Protection of Intellectual Property of Insolvent Debtors in Bankruptcy Perspective. International Journal of Social Service and Research, 3(8), 1860-1868. https://doi.org/10.46799/ijssr.v3i8.479

Zhang, L., Song, Y., Liu, S., & Zhang, M. (2023). Analysis on China's provincial carbon emission quota allocation based on bankruptcy game. Environmental Impact Assessment Review, 103, 107287. https://doi.org/10.1016/j.eiar.2023.107287

Zhao, J. (2024). Survey, classification and critical analysis of the literature on corporate bankruptcy and financial distress prediction. Machine Learning with Applications.

Downloads

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2026 Mohammadkazem Mohtashami zadeh (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.