Modeling the Role of Accounting in Enhancing Financial Performance, Technological Innovation, and Sustainability of Knowledge-Based Companies: A Structural Equation Modeling (SEM) Approach

Keywords:

Accounting, Financial Performance, Technological Innovation, Sustainability, Knowledge-Based CompaniesAbstract

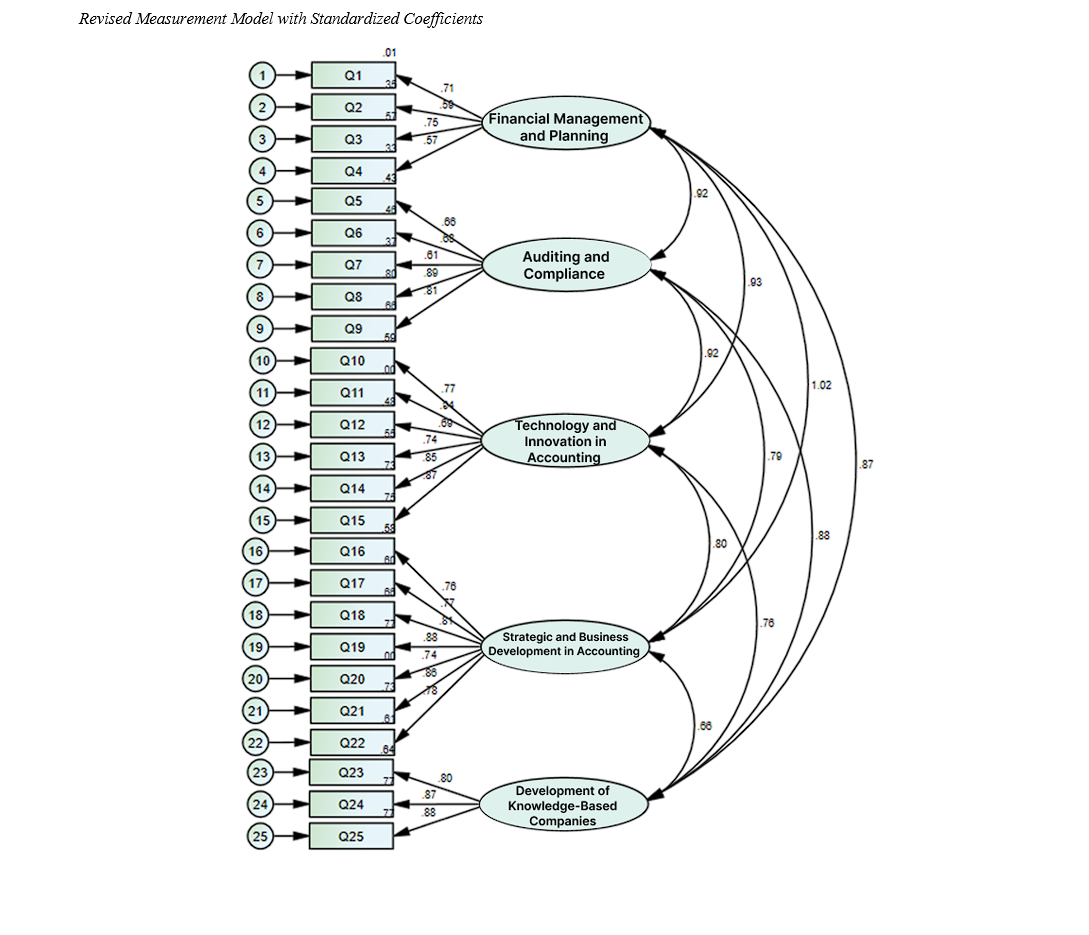

The objective of this study is to model the role of accounting in enhancing financial performance, technological innovation, and sustainability of knowledge-based companies. Considering the importance of these companies in a knowledge-driven economy and the existing challenges related to financial transparency, capital attraction, and sustainable development, examining the role of accounting systems can open new horizons for improving managerial decision-making and strengthening competitive capabilities. This research is applied in purpose and descriptive–survey and quantitative in method. The statistical population in the qualitative phase consisted of accounting faculty members with more than ten years of executive experience, who were selected through purposive sampling. Semi-structured interviews were conducted until theoretical saturation was reached. In the quantitative phase, the statistical population included all accountants working in knowledge-based companies. Using the Krejcie and Morgan table, a sample of 384 participants was selected. The data collection tool was a researcher-designed questionnaire with 25 items across five main dimensions of the study. Its validity was confirmed by subject-matter experts, and its reliability was verified with a Cronbach’s alpha coefficient greater than 0.8. Data analysis was conducted using Structural Equation Modeling (SEM) with SPSS and AMOS software. The findings showed that accounting has a positive and significant effect on the financial performance, technological innovation, and sustainability of knowledge-based companies. In other words, the presence of transparent and efficient accounting systems can not only improve financial management and attract capital but also create conditions for the development of innovative activities and enhancement of organizational sustainability.

References

Al-Dmour, A., Zaidan, H., & Al Natour, A. R. (2023). The impact of knowledge management processes on business performance via the role of accounting information quality as a mediating factor. VINE Journal of Information and Knowledge Management Systems, 53(3), 523-543. https://doi.org/10.1108/VJIKMS-12-2020-0219

Al-Hattami, H. M., & Kabra, J. D. (2024). The influence of accounting information system on management control effectiveness: The perspective of SMEs in Yemen. Information Development, 40(1), 75-93. https://doi.org/10.1177/02666669221087184

Bani Mahd, A. (2012). The quality of accounting information and its role in reducing information asymmetry. Quarterly Journal of Financial Accounting, 4(15), 25-40.

Barth, M. E., & Gee, K. H. (2024). Accounting and Innovation: Paths forward for research. Journal of Accounting and Economics, 101733. https://doi.org/10.1016/j.jacceco.2024.101733

Beaver, W. H., & Ryan, S. G. (2000). Biases and lags in book value and their effects on the ability of the book-to-market ratio to predict book return on equity. Journal of Accounting and Economics, 29(3), 233-267. https://doi.org/10.1016/0165-4101(81)90004-5

Bushman, R. M., & Landsman, W. R. (2010). The pros and cons of regulating corporate reporting: A critical review of the arguments. Accounting and Business Research, 40(3), 231-256. https://doi.org/10.1080/00014788.2010.9663400

Ghorbani, S. (2025). Analysis and Explanation of Financial Accounting Theory Based on the Conceptual Framework of the Financial Accounting Standards Board. Journal of Accounting and Management Auditing, 53, 37-53.

Johri, A. (2025). Impact of artificial intelligence on the performance and quality of accounting information systems and accuracy of financial data reporting. In (pp. 1-25). https://doi.org/10.1080/01559982.2025.2451004

Karimi, Z., Zanjirchi, S. M., Mirfakhrodini, S. H., & Mirghafoori, S. H. (2024). Presenting a model for the competitiveness of selected Iranian knowledge-based companies in the Fourth Industrial Revolution. International Journal of Nonlinear Analysis and Applications, 15(11), 309-318. https://www.magiran.com/paper/2665416/investigating-the-factors-affecting-the-competitiveness-of-selected-knowledge-based-companies-in-the-fourth-industrial-revolution?lang=en

Khayatian, M. (2016). Identifying concepts related to knowledge-based companies and learning organizations. Quarterly Journal of Technology Development, 8(2), 45-62.

Kholdarov, M., & Khatamova, Z. (2025). Digital Transformation Of Accounting And Financial Management. Международный журнал научных исследователей, 10(1), 588-592.

Kim, S., & Park, H. (2024). Financial resource optimization for sustainable growth in knowledge-based companies. Technovation, 123, 102512.

Lambert, R., Leuz, C., & Verrecchia, R. (2007). Accounting information, disclosure, and the cost of capital. Journal of Accounting Research, 45(2), 385-420. https://doi.org/10.1111/j.1475-679X.2007.00238.x

Lev, B., & Zarowin, P. (1999). The boundaries of financial reporting and how to extend them. Journal of Accounting Research, 37(2), 353-385. https://doi.org/10.2307/2491413

Lotfi, S. (2023). The theoretical framework of financial reporting and the objectives of accounting standardization. Quarterly Journal of Accounting and Auditing, 30(4), 15-28.

Malek Hosseini, H. R., Arab Salehi, M., & Foroughi, D. (2025). The impact of board characteristics through modern management accounting techniques on firms' financial performance. Management Accounting and Auditing Knowledge, 14(54), 17-36.

Mehrshad, M., & Naderi, N. (2024). Proposing a model to develop the entrepreneurial ecosystem of knowledge-based companies with an emphasis on entrepreneurship education (Case Study: Knowledge-based companies in Kermanshah Province). Industrial Innovations: Needs and Solutions, 2(1), 88-102. https://doi.org/10.61186/jii.2.1.88

Meyzari Hormozabadi, M., & Naderi Bani, R. (2017). Characteristics of capital market transactions and their effect on the pricing of accounting valuation models. Quarterly Journal of Financial Accounting, 9(34), 71-101. https://www.sid.ir/paper/168159/en

Moradi, M. (2024). Definition and functions of accounting in economic organizations. Journal of Accounting Research, 17(2), 101-120.

Norooz Zadeh, D., & Abas Zadeh Asl, L. (2022). An analysis of the effects of dynamic accounting information systems on sustainable competitiveness within the framework of a knowledge-based economy. The 7th International Conference on New Perspectives in Management, Accounting, and Entrepreneurship, Tehran.

Pratiwi, A. E., & Ermaya, H. N. L. (2024). Implementation of Blockchain Technology on Accounting Information System for Transaction Security and Data Reliability. JASa (Jurnal Akuntansi, Audit dan Sistem Informasi Akuntansi), 8(1), 64-74. https://doi.org/10.36555/jasa.v8i1.2419

Rajan, M. V., Reichelstein, S., & Soliman, M. (2007). Conservatism, growth, and the role of accounting numbers in valuation. Review of Accounting Studies, 12(2-3), 325-370. https://doi.org/10.1007/s11142-007-9035-2

Rasyid, A., Ariani, D., Kusumaningati, I. D., Atmadjaja, Y. V. I., & Durya, N. P. M. A. (2024). Analysis of the influence of integrated system development, accounting technological updates and management support on accounting information system performance. Jurnal Informasi Dan Teknologi, 235-239. https://doi.org/10.60083/jidt.v6i1.505

Shahroudi, A. (2024). Designing a model for determining the technological complexity level of research and development activities in knowledge-based companies. Quarterly Journal of Innovation and Technology Research, 12(1), 77-95.

Shahroudi, G. A., Torabi, T., Radfar, R., & Cheraghali, M. H. (2024). Designing a model to determine the complexity level of research and development activities in knowledge-based companies. International Journal of Nonlinear Analysis and Applications, 15(8), 247-258. https://ijnaa.semnan.ac.ir/article_8087.html

Smith, R., Johnson, L., & Wang, S. (2024). Transparency in financial reporting and firm performance in tech startups. Journal of Business Finance & Accounting, 51(5-6), 857-879.

Downloads

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2025 Moein Ilaghi Hosseini (Author); Abbasali Haghparast; Alireza Hirad, Habib Piri (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.