Identification of the Components of a Conceptual Model for Effective Risk Management Based on the Grounded Theory Method

Keywords:

Risk management, grounded theory, causal conditions, strategies, value creation, resilience, organizational governanceAbstract

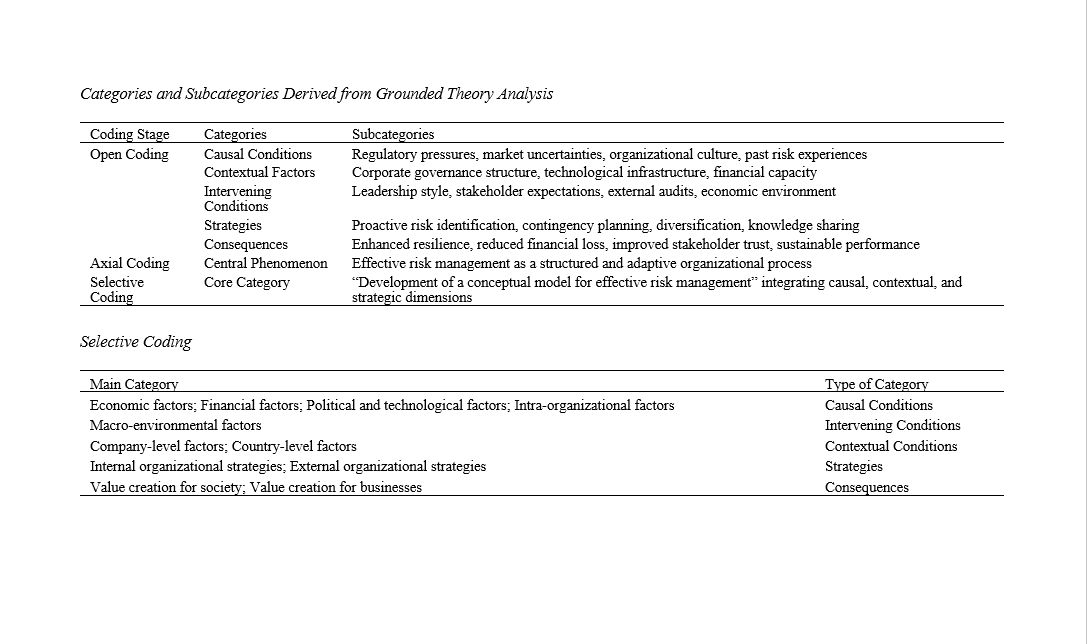

This study aims to identify and conceptualize the components of an effective risk management model through a grounded theory approach, providing a comprehensive framework that integrates causal, contextual, and strategic dimensions of organizational risk management. The research employed a qualitative design using the grounded theory methodology of Strauss and Corbin. The study population consisted of university professors, risk managers, members of risk committees, and board members of listed companies. Due to the broad scope of the population, purposeful and snowball sampling methods were applied, resulting in 14 participants, with theoretical saturation achieved at the fourteenth interview. Data were collected through semi-structured interviews and analyzed using NVivo and MAXQDA software. The analysis followed a systematic coding process including open, axial, and selective coding, enabling the development of categories and integration into a conceptual model. The results indicated that effective risk management is shaped by a combination of causal, contextual, and intervening factors. Causal conditions included economic, financial, political, technological, and intra-organizational factors. Contextual conditions were identified at both company and country levels, while intervening conditions encompassed macro-environmental factors, leadership styles, and stakeholder expectations. Strategies were divided into internal (e.g., governance reforms, proactive identification, knowledge sharing) and external (e.g., collaboration, regulatory adaptation) categories. The consequences of these strategies highlighted value creation for both organizations, through resilience and financial performance, and society, through trust and stability. The central phenomenon identified was risk management as a structured and adaptive process. The study contributes a conceptual model of effective risk management that integrates multiple dimensions, emphasizing its role not only in reducing vulnerabilities but also in creating long-term organizational and societal value.

References

Abu Afifa, M., Nguyen, N. M., & Bui, D. V. (2024). Management accounting practices going sustainable: the move toward sustainable risk management in ASEAN developing economies. Competitiveness Review: An International Business Journal, ahead-of-print. https://doi.org/10.1108/CR-03-2024-0056

Ahmadi-Farsani, F., Abroud, A., & Derakhshan, A. (2024). The impact of business risk management on reducing financial distress conditions, considering the role of corporate oversight mechanisms. Journal of Applied Research in Financial Reporting, 13(24), 123-150. https://www.arfr.ir/article_205753.html?lang=en

Al Qudah, S. M. A., Fuentes Bargues, J. L., & Gisbert, P. (2024). Bibliometric analysis of the literature on risk management in the construction sector: Exploring current and future trends. Ain Shams Engineering Journal, 102843.

Amin, H. E. (2024). An Integrated Approach to Cyber Risk Management With Cyber Threat Intelligence Framework to Secure Critical Infrastructure. Journal of Cybersecurity and Privacy, 4(2), 357-381. https://doi.org/10.3390/jcp4020018

Bazaluk, O., Pavlychenko, A., Yavorska, O., Nesterova, O., Tsopa, V., Cheberiachko, S., Deryugin, O., & Lozynskyi, V. (2024). Improving the risk management process in quality management systems of higher education. Scientific reports, 14(1), 3977. https://doi.org/10.1038/s41598-024-53455-9

Braicov, A. (2024). Transformational Risk Management in Mathematics and IT Education in the Republic of Moldova. Acta Et Commentationes Științe Ale Educației, 37(3), 29-37. https://doi.org/10.36120/2587-3636.v37i3.29-37

Cai, Y. (2024). Electronic Commerce Security and Risk Management: An Important Part of College Curriculum. Journal of Educational Theory and Management, 8(1), 18. https://doi.org/10.26549/jetm.v8i1.15646

Castelblanco, G., Fenoaltea, E. M., De Marco, A., Demagistris, P., Petruzzi, S., & Zeppegno, D. (2024). Combining stakeholder and risk management: Multilayer network analysis for complex megaprojects. Journal of Construction Engineering and Management, 150(2), 04023161. https://doi.org/10.1061/JCEMD4.COENG-13807

Djakman, C. D., & Siregar, S. V. (2024). The Effect of Maturity Learn Element in Enterprise Risk Management and Corporate Social Responsibility on the Level of Digital Transformation. Business Strategy & Development, 7(1). https://doi.org/10.1002/bsd2.346

Faqih Nasiri, A., Yarahmadi, M., & Tamjid Yamchalu, A. (2024). Providing a risk management model for imports in the Islamic Republic of Iran Customs with a focus on the role of transformative senior managers. In Proceedings of the 11th International and National Conference on Management, Accounting, and Law,

Gapurbaeva, S. (2024). International River and Sea Transportation: Specifics of Risk Management in Cryptocurrency Transactions. Bio Web of Conferences, 107, 04006. https://doi.org/10.1051/bioconf/202410704006

Hasanzadeh Talooki, M. (2024). Educational risk management in the use of educational technologies. Journal of Clinical Excellence, 14(1). https://ce.mazums.ac.ir/article-1-826-fa.html

Horvey, S. S., & Odei-Mensah, J. (2025). Enterprise risk management, corporate governance and insurers risk-taking behaviour in South Africa: evidence from a linear and threshold analysis. Journal of Accounting in Emerging Economies, 15(1), 53-83. https://doi.org/10.1108/JAEE-08-2023-0242

Hristov, I., Camilli, R., Chirico, A., & Mechelli, A. (2024). The integration between enterprise risk management and performance management system: Managerial analysis and conceptual model to support strategic decision-making process. Production Planning & Control, 35(8), 842-855. https://doi.org/10.1080/09537287.2022.2140086

Kayouh, N., & Dkhiss, B. (2024). The Impact of Proactive Risk Management, Collaboration, and Digital Tools on Supply Chain Performance in the Moroccan Automotive Industr. Uncertain Supply Chain Management, 13(4), 763-772. https://doi.org/10.5267/j.uscm.2024.12.100

Lee, S. N. (2024). Examining the Impact of Organizational Culture and Risk Management and Internal Control on Performance in Healthcare Organizations. Advances in Management and Applied Economics, 14(1), 1-4.

Mara, G. C., Kumar, Y., K, V. P., Madan, S., & Chandana, R. A. M. (2025). Advance AI and Machine Learning Approaches for Financial Market Prediction and Risk Management: A Comprehensive Review. Journal of Computer Science and Technology Studies, 7(4), 727-749. https://doi.org/10.32996/jcsts.2025.7.4.86

Mirza, H. H., Hussain, H., Hussain, R. Y., Ahmed, M., & Adil, M. (2024). Corporate Disclosure and Transparency as a Tool of Socially Responsible Risk Management. 91-104. https://doi.org/10.4018/979-8-3693-5733-0.ch004

Munyao, D. K., Deya, J., & Odollo, L. (2025). Strategic Risk Management and Performance of Commercial State Corporations in Kenya. International Journal of Social Science and Humanities Research (Ijsshr) Issn 2959-7056 (O) 2959-7048 (P), 3(1), 97-111. https://doi.org/10.61108/ijsshr.v3i1.157

Olawale, O., Ajayi, F. A., Udeh, C. A., & Odejide, O. A. (2024). Risk management and HR practices in supply chains: Preparing for the Future. Magna Scientia Advanced Research and Reviews, 10(2), 238-255. https://doi.org/10.30574/msarr.2024.10.2.0065

Petare, P. A., Bdair, M., Singh, M. N., Ateeq, K., & Akila, R. (2024). Big data analytics in fintech: Revolutionizing risk management and decision-making. Acta Scientiae, 7(1), 605-617.

Pourahmadi, M. H., Farsad Amanollahi, G., & Lashgari, Z. (2024). Factors Affecting Enterprise Risk Management in Companies Listed on Tehran Stock Exchange. Investment Knowledge, 13(50), 95-109.

Qian, C., & Arkadievna, A. (2024). Stability and risk management of global supply chains in foreign trade economy. American Journal of Economics and Business Innovation. https://doi.org/10.54536/ajebi.v3i1.2362

Rachid, B., Roland, D., Sebastien, D., & Ivana, R. (2024). Risk Management Approach for Lean, Agile, Resilient and Green Supply Chain. World Academy of Science, Engineering and Technology, International Journal of Social, Behavioral, Educational, Economic, Business and Industrial Engineering, 11(4), 742-750. https://publications.waset.org/10006688/risk-management-approach-for-lean-agile-resilient-and-green-supply-chain

Safaeian, M., Moses, R., Ozguven, E. E., & Dulebenets, M. A. (2024). An optimization- based risk management framework with risk interdependence for effective disaster risk reduction. Progress in Disaster Science, 21, 100313. https://doi.org/10.1016/j.pdisas.2024.100313

Temba, G. I., Kasoga, P. S., & Keregero, C. M. (2024). Impact of the quality of credit risk management practices on financial performance of commercial banks in Tanzania. SN Business & Economics, 4(3), 38. https://doi.org/10.1007/s43546-024-00636-3

Testorelli, R., Tiso, A., & Verbano, C. (2024). Value Creation with Project Risk Management: A Holistic Framework. Sustainability, 16(2), 753. https://doi.org/10.3390/su16020753

Wong, L. W., Tan, G. W. H., Ooi, K. B., Lin, B., & Dwivedi, Y. K. (2024). Artificial intelligence-driven risk management for enhancing supply chain agility: A deep-learning-based dual-stage PLS-SEM-ANN analysis. International Journal of Production Research, 62(15), 5535-5555. https://doi.org/10.1080/00207543.2022.2063089

Yazdi, M., Zarei, E., Adumene, S., & Beheshti, A. (2024). Navigating the Power of Artificial Intelligence in Risk Management: A Comparative Analysis. Safety, 10(2), 42. https://doi.org/10.3390/safety10020042

Zhu, D., Li, Z., & Mishra, A. R. (2023). Evaluation of the critical success factors of dynamic enterprise risk management in manufacturing SMEs using an integrated fuzzy decision-making model. Technological Forecasting and Social Change, 186, 122137. https://doi.org/10.1016/j.techfore.2022.122137

Downloads

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2025 Amir Mirzaee (Author); Ali Lalbar; Azar Moslemi, Mohammad Reza Ghorbanian (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.