Designing a Stock Return Prediction Model Using Novel Composite Variables in the Tehran Stock Exchange with an Integrated DEMATEL and Interpretive Structural Modeling Approach

Keywords:

Stock return, composite variables, stock return prediction, stock exchangeAbstract

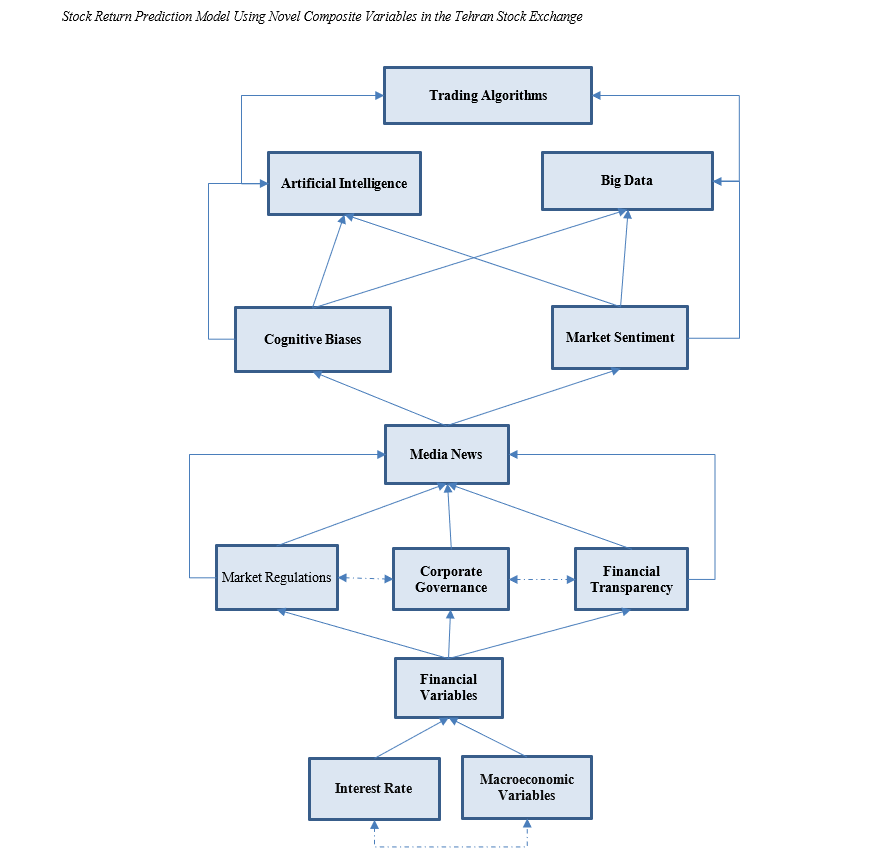

The purpose of this study was to design a model for predicting stock returns of companies using novel composite variables in the Tehran Stock Exchange. In terms of objective, this research is developmental–applied. The method used in this study is mixed, which includes the historical method (data collection) and the survey method (questionnaire distribution). Additionally, to collect and write the theoretical foundations of the research, articles, books, and reputable available sources were utilized. The statistical population and sample of this study consist of experts familiar with accounting and stock exchange concepts. The sampling method is purposive. The methods employed in this research are DEMATEL techniques and Interpretive Structural Modeling (ISM). The software used included EXCEL and MICMAC. Twelve indicators were identified. These indicators are: financial variables, macroeconomic variables, interest rate, cognitive biases, market sentiment, media news, artificial intelligence, trading algorithms, big data, corporate governance, market regulations, and financial transparency. The proposed model for predicting stock returns, based on novel composite variables in the Tehran Stock Exchange, with a comprehensive, integrative, and multilayered perspective, has succeeded in narrowing the gap between theory and market reality. Understanding the interaction between technology, investor psychology, institutional environment, and economic data has opened a new horizon in analyzing and predicting market behavior. Such a model not only has a high predictive capacity but also serves as a tool for deeper understanding of market dynamics, policymaking, designing innovative financial instruments, and enhancing market transparency. Therefore, this model is considered an effective step in the scientific development of Iran’s capital market.

References

Afshin Seyed Mohammad, M., Mohammadzadeh, A., Rezaei, F., & Abbasi, E. (2025). Identification of Stock Return Components Using Novel Composite Variables in Tehran Stock Exchange. Accounting, Finance, and Computational Intelligence, 3(1), 1-20. https://jafci.com/index.php/jafci/article/view/126

Akyildirim, E., Bariviera, A. F., Nguyen, D. K., & Sensoy, A. (2022). Forecasting high-frequency stock returns: A comparison of alternative methods. Annals of Operations Research. https://doi.org/10.1007/s10479-021-04464-8

Amini Mehr, A., Bajelan, S., & Hekmat, H. (2021). A Study on the Behavior of Return Variable Data in Tehran Stock Exchange and Providing a Regime-Switching Forecasting Method Based on Deep Neural Networks. Financial Management Perspective, 11, 145-171. https://doi.org/10.52547/jfmp.11.34.145

Anderson, K., Chowdhury, A., & Uddin, M. (2025). Piotroski's Fscore under varying economic conditions. Review of Quantitative Finance and Accounting, 64, 1261-1307. https://doi.org/10.1007/s11156-024-01331-y

Azevedo, V., Kaiser, G. S., & Mueller, S. (2023). Stock market anomalies and machine learning across the globe. Journal of Asset Management, 24, 419-441. https://doi.org/10.1057/s41260-023-00318-z

Chen, J., Tang, G., Yao, J., & Zhou, G. (2022). Investor attention and stock returns. Journal of Finance Quantitative Analysis, 57(2), 455-484. https://doi.org/10.1017/S0022109021000090

Chen, S., & Alexiou, C. (2025). Digital Transformation as a Catalyst for Resilience in Stock Price Crisis: Evidence from A 'New Quality Productivity' Perspective. Asia-Pacific Finance Markets. https://doi.org/10.1007/s10690-025-09517-7

Cheng, T., Gao, J., & Linton, O. (2019). Nonparametric predictive regressions for stock return predictions. Cambridge Working Papers in Economics, 1932. https://www.tandfonline.com/doi/abs/10.1080/07474938.2025.2519389

Das, A. K., Mishra, D., & Das, K. (2021). Predicting Stock Market Movements: An Optimized Extreme Learning Approach. In Cognitive Informatics and Soft Computing. Advances in Intelligent Systems and Computing (Vol. 1317). Springer. https://doi.org/10.1007/978-981-16-1056-1_55

Das, S., Sahu, T. P., & Janghel, R. R. (2022). Effective forecasting of stock market price by using extreme learning machine optimized by PSO-based group oriented crow search algorithm. Neural Computing & Applications, 34, 555-591. https://doi.org/10.1007/s00521-021-06403-x

de Sousa-Gabriel, V. M., Lozano-García, M. B., & Matias, M. F. L. I. (2024). Global environmental equities and investor sentiment: the role of social media and Covid-19 pandemic crisis. Review of managerial science, 18, 105-129. https://doi.org/10.1007/s11846-022-00614-9

Diebold, F., & Shin, M. (2019). Machine learning for regularized survey forecast combination: Partially egalitarian LASSO and its derivatives. International Journal of Forecasting, 35, 1679-1691. https://doi.org/10.1016/j.ijforecast.2018.09.006

Gong, X., Zhang, W., & Xu, W. (2022). Uncertainty index and stock volatility prediction: evidence from international markets. Financial Innovation, 8, 57. https://doi.org/10.1186/s40854-022-00361-6

Haghighi Naeini, K., Khanjani, M., & Rostgar Sorkheh, M. A. (2023). Development of a Hybrid VMD-LSTM Model for Stock Price Prediction in Tehran Stock Exchange. Proceedings of the First International Conference on Management Capability, Industrial Engineering, Accounting, and Economics, Babolsar.

Hasan, F., & Al-Najjar, B. (2025). Calendar anomalies and dividend announcements effects on the stock markets returns. Review of Quantitative Finance and Accounting, 64, 829-859. https://doi.org/10.1007/s11156-024-01321-0

Huang, Y., & Luk, P. (2020). Measuring economic policy uncertainty in China. China Economic Review, 59, 1-18. https://doi.org/10.1016/j.chieco.2019.101367

Kazak, H., Saiti, B., & Kılıç, C. (2024). Impact of Global Risk Factors on the Islamic Stock Market: New Evidence from Wavelet Analysis. Computational Economics. https://doi.org/10.1007/s10614-024-10665-7

Khan, M. N., Fifield, S. G. M., & Power, D. M. (2024). The impact of the COVID 19 pandemic on stock market volatility: evidence from a selection of developed and emerging stock markets. SN Business & Economics, 4, 63. https://doi.org/10.1007/s43546-024-00659-w

Kyriakou, I., Mousavi, P., Nielsen, J. P., & Scholz, M. (2020). Longer-term forecasting of excess stock returns the five-year case. Mathematics, 8, 1-20. https://doi.org/10.3390/math8060927

Liang, C., Wei, Y., & Zhang, Y. (2020). Is implied volatility more informative for forecasting realized volatility: an international perspective. Journal of Forecasting, 39(8), 1253-1276. https://doi.org/10.1002/for.2686

Liu, J., Zhang, Z., Yan, L., & Wen, F. (2021). Forecasting the volatility of EUA futures with economic policy uncertainty using the GARCH-MIDAS model. Finance Innovation, 7(1), 1-19. https://doi.org/10.1186/s40854-021-00292-8

Manjazeb, M., Jafari, F., & Ghasemi, Y. (2023). Comparison of Volatility Forecasting of Tehran Stock Exchange Stocks Using GARCH-MIDAS and Quantile Regression Approaches. Econometric Modeling, 8, 163-194. https://jem.semnan.ac.ir/article_8006.html

Melina, Sukono, Herlina, N., & Norizan, M. (2023). A Conceptual Model of Investment-Risk Prediction in the Stock Market Using Extreme Value Theory with Machine Learning: A Semi Systematic Literature Review. Risks, 11(3), 60. https://doi.org/10.3390/risks11030060

Metiu, N., Prieto, E., Rapach, D., & Zhou, G. (2023). Time-Varying Stock Return Correlation, News Shocks, and Business Cycles Time-series and cross-sectional stock return forecasting: new machine learning methods (Machine Learning for Asset Management: New Developments and Financial Applications, Issue.

Moradi, B., Bahri Thaleth, J., Jabbarzadeh Kangarlooi, S., & Ashtab, A. (2022). Development and Presentation of a Model for Predicting Stock Liquidity in Tehran Stock Exchange. Financial Research, 24, 134-156. https://jfr.ut.ac.ir/article_87754.html?lang=fa

Najarzadeh, R., Zolfaghari, M., & Gholami, S. (2020). Designing a Model for Predicting Variable Stock Returns with Emphasis on Hybrid Neural Network and Long Short-Term Memory Models. Investment Science, 9, 231-257. http://www.jik-ifea.ir/article_16207.html

Nasiri, Z., Sarraf, F., Tenhaei, M., Emamvardi, G., & Najafi Moghadam, A. (2023). Forecasting Volatility of Tehran Stock Exchange Variables Using Quantum Harmonic Oscillator Volatility Model. Accounting and Auditing Research, 15, 89-110. https://www.iaaaar.com/article_172754.html?amp;lang=en&lang=en&lang=fa&lang=en&lang=en

Rostami, Z., Fattahi, S., & Soheili, K. (2023). Modeling and Estimation of Tehran Stock Exchange Returns Using Dynamic Models. Financial Economics, 17, 185-206. https://journals.iau.ir/article_700132.html

Sakariyahu, R., Paterson, A., & Chatzivgeri, E. (2024). Chasing noise in the stock market: an inquiry into the dynamics of investor sentiment and asset pricing. Review of Quantitative Finance and Accounting, 62, 135-169. https://doi.org/10.1007/s11156-023-01214-8

Samal, S., & Dash, R. (2023). Developing a novel stock index trend predictor model by integrating multiple criteria decision-making with an optimized online sequential extreme learning machine. Granular Computing, 8, 411-440. https://doi.org/10.1007/s41066-022-00338-x

Shen, J., & Shafiq, M. O. (2020). Short-term stock market price trend prediction using a comprehensive deep learning system. Journal of Big Data, 7, 66. https://doi.org/10.1186/s40537-020-00333-6

Sonkavde, G., Dharrao, D. S., Bongale, A. M., Deokate, S. T., Doreswamy, D., & Bhat, S. K. (2023). Forecasting Stock Market Prices Using Machine Learning and Deep Learning Models: A Systematic Review, Performance Analysis and Discussion of Implications. International Journal of Financial Studies, 11(3), 94. https://doi.org/10.3390/ijfs11030094

Tarasov, V. E. (2020). Fractional econophysics: Market price dynamics with memory effects. Physica A: Statistical Mechanics and its Applications, 557, 1-33. https://doi.org/10.1016/j.physa.2020.124865

Vatsa, P., Basnet, H. C., & Mixon, F. G. (2024). Stock Markets Cycles and Macroeconomic Dynamics. International Advances in Economic Research, 30, 255-278. https://doi.org/10.1007/s11294-024-09901-5

Wang, J., Lu, X., He, F., & Ma, F. (2020). Which popular predictor is more useful to forecast international stock markets during the coronavirus pandemic: VIX vs EPU? International Review of Financial Analysis, 72, 101596. https://doi.org/10.1016/j.irfa.2020.101596

Wu, W., Chen, J., Xu, L., He, Q., & Tindall, M. (2020). A statistical learning approach for stock selection in the Chinese stock market. Financial Innovation, 5, 1-18. https://doi.org/10.1186/s40854-019-0137-1

Yan, X., Bai, J., Li, X., & Chen, Z. (2022). Can dimensional reduction technology make better use of the information of uncertainty indices when predicting volatility of Chinese crude oil futures? Resources Policy, 75, 102521. https://doi.org/10.1016/j.resourpol.2021.102521

Zeinali, G., & Yazdanian, N. (2021). Stock Return Forecasting Based on Kernel Distribution and Mixture of Normal Distributions. Financial Engineering and Securities Management, 12, 587-606. https://journals.iau.ir/article_682745.html

Zhang, H., He, Q., Jacobsen, B., & Jiang, F. (2020). Forecasting stock returns with model uncertainty and parameter instability. Journal of Applied Econometrics, 35, 629-644. https://doi.org/10.1002/jae.2747

Zhang, W., Gong, X., Wang, C., & Ye, X. (2021). Predicting stock market volatility based on textual sentiment: a nonlinear analysis. Journal of Forecasting, 40(8), 1479-1500. https://doi.org/10.1002/for.2777

Zhang, Y., Ma, F., & Liao, Y. (2020). Forecasting global equity market volatilities. International Journal of Forecasting, 36(4), 1454-1475. https://doi.org/10.1016/j.ijforecast.2020.02.007

Zhao, Y., Zhang, W., Gong, X., & Wang, C. (2021). A novel method for online real-time forecasting of crude oil price. Applied Energy, 303, 117588. https://doi.org/10.1016/j.apenergy.2021.117588

Downloads

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2025 Seyed Mohammad Mehdi Afshin (Author); Amir Mohammadzadeh; Farzin Rezaei, Ebrahim Abbasi (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.